AstraDux Capital AG is a Swiss company located in the heart of Zug, Switzerland. The company focus is providing tailored financial advisory services. The company was founded in 2011 and is listed in the commercial registry of the canton of Zug (CHE-482.285.420). AstraDux Capital AG operates as a regulated company licensed under ARIF SRO for financial advisory offering risk control approach for both the conservative and active dynamic investor. ARIF is a self-regulating body approved by the Swiss Financial Market Supervisory Authority (FINMA) for the supervision of the financial intermediaries referred to in article 2 para. 3 of the Swiss Federal Law on combating money laundering and terrorism financing (AMLA). Our team helps individuals and institutions to identify their investment goals by translating individual risk tolerance and investment duration requirements into objective and executable investment plans. For this reason, the ambition of the company is to act as one of the forefront companies in the Swiss market, leading by example. Our client's success is one of our top priorities that we achieve by tailored solutions for their financial freedom. The success factor is our long-lasting expertise in the financial sector. Therefore, our aim is to become one of the biggest financial advisory companies in Switzerland and to expand our services to Wealth and Asset Management.

Fear and uncertainty have increased due to faster recurring crises. Political instability leads to uncertainty on the Exchanges resulting in extreme fluctuations causing serious losses and reduction of wealth. Saving accounts and bonds have become unattractive due to low interest rates. As the environment for the investors is more uncertain than ever, the dilemma about how to preserve assets hasn't been more pronounced for a long time. Investors are facing two main challenges. For long term investors the most concerning issue is the risk of currency devaluation in which they choose to store their funds. The savings and returns made with investments can become devalued after many years if the currency you use does not hold its value. Shorter term pain for the investors comes from negative interest rates on bank account deposits. It goes beyond merely loosing value every day on a bank deposit. Money is pushed to move, and the diversification alone is not a sufficient answer to obtain a stable pay-out. In the open market this has consequences also for leveraged investment approaches, because negative interest rates translated into higher costs of leverage. The environment therefore prohibits static behaviour and at the same time imposes charges on risk taking

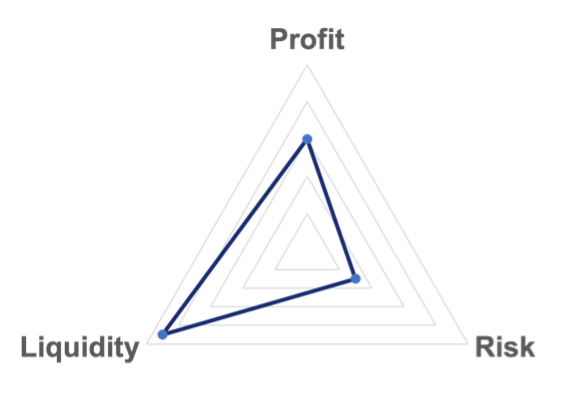

We offer financial advisory to wealthy individuals, corporate clients and institutions. We advise clients in all phases of life and business. We identify needs and provide outstanding and tailored solutions related to clients' requirements to achieve high profits, financial freedom and wealth preservation. The service includes not only advisory but also financial planning, legal advice, tax optimizations and suitable investment plans. Our services stretch across globally from our head office in Zug. In addition, the broad range of asset classes gives us the ideal possibility to diversify and to tailor a profitable portfolio according to your risk tolerance. For our success we can rely on vast experience, a broad range of products in various sectors and a variety of Partners.

Wealthy families are faced with considerable change and new challenges across several aspects over the next decade. As wealthy families become more global and diversified in their holdings, the complexity of managing the portfolio increases significantly. On the other hand, augmented scrutiny and legislative pressures demand greater transparency of wealth structure. Nevertheless, wealthy families are increasingly considering setting up a family office. However, a family office poses plenty of difficulties regarding the founding, structuring, wealth management and in many other aspects. For these reasons, the support of specialists is crucial. Our multi-disciplined team and international team can provide holistic and independent advice based on professional expertise. The offered support includes, to name some, investment, and wealth planning and the structuring of Trusts, which allow clients to protect and on the other hand massively increase their wealth. Furthermore, the choice of our various partners offers an assortment of exclusive services like Concierge services, acquisition of jewelry, boats, real estates as well as other luxury objects, travel, and many more.

The driver behind the company’s ambitions is to connect tradtional, alternative and digital assets and consequently the new and the old marketplaces. We support our tailored soulutions for the investors need for the portfolio stability on one side and a competitive participation in new investment opportunities on the other. The best stable answers are provided in the established traditional system. However, alternative assets and the digital markets produce opportunities faster, opening a new way of targeting higher upside goals. AstraDux Capital uses its own analytical architecture and continuous cost-benefit evaluation of safe and risky investments to approach the principle of combined Traditional & Digital asset management. With the product diversification the company provides a unique benefit to the investors who can now generate revenue from both worlds with a single investment.

Our Custom Solutions offer adjustable programmes for any requirement level from advanced individual setups to professional institutional and B2B configurations.

| Target Range | Up to 40 % p.a. |

| Return Probability | 90 - 99 % |

| Liquidity | 3 months for the whole investment capital otherwise no restrictions |

| Ideal Time Horizon | 5-10 Years |

| Return Model | Monthly Returns |

Being historically, politically, and economically stable Switzerland is in the heart of Europe and is the ideal place to conduct business. All services are based on a contractual relationship under Swiss law and are companied with Swiss client confidentiality.